Data-driven sourcing technology may be the answer

Contents:

- The Current State of Manufacturing Supply Chains

- The Importance of Data Collection

- Data Analysis in Action

- Streamlining Supplier Evaluation with Limited Resources

- Risk Management Strategies

- Quick Wins in Cost Optimization

- The Role of Market Intelligence in Manufacturing Supply and Sourcing Trends

- Backup Supply Options to Keep Manufacturing Running

Introduction

It is projected 2023 will end with a $200 billion decline in gross output. While this projection is bleak for 2023, what does it mean for 2024?

As we enter 2024, the manufacturing sector is continuing to grapple with a confluence of supply chain risks that threaten to disrupt both production schedules and bottom lines. Whether it’s manufacturing procurement challenges, unprecedented staff shortages, or bottlenecks in the supply of raw materials, the industry is facing issues from multiple angles. Add inflation into the mix, and it becomes clear that sourcing risk is higher than ever. The stakes have never been higher. So, how can companies optimize supplier performance and mitigate risks?

The answer may very well lie in strategic sourcing backed by sourcing technology and data-driven insights. In this article we will provide actionable steps and expert guidance in core areas such as data collection, supplier evaluation, and risk management to help you navigate common pain points like delays and material shortages. We’ll help you bulletproof your supply chain by leveraging data and making informed decisions, including the benefits of nearshoring and supply diversity.

Section 1: The Current State of Manufacturing Supply Chains

In 2023, manufacturing supply chains are under intense strain due to various factors that can be broadly categorized under supply chain risks. These include:

Staff Shortages

The problem of staff shortages can be attributed to a combination of factors such as the aging workforce, skill gaps, and changes in immigration policies. The pandemic accelerated the adoption of remote work, but roles in manufacturing often require on-site presence. This has led to a reduced labour pool, as fewer people are willing to commit to on-site jobs that may also carry health risks. With technology evolving at an unprecedented pace, companies find themselves lacking the necessary skilled labor to operate sophisticated machinery.

The COVID-19 pandemic and demographic shifts have led to significant staff shortages in the manufacturing industry. As a result, companies are considering strategic sourcing of talent and upskilling existing staff to bridge the gap.

Raw Material Shortages

Global events, including geopolitical tensions and climate-related disruptions, have created a bottleneck in the availability of essential raw materials. Materials that used to be commonplace and commoditized are now scarce and disruptive to a number of supply chains.

For instance, the automotive industry has been hit hard by the scarcity of semiconductors, while the construction sector is struggling with the availability of steel and lumber. Such shortages drive up prices and lead times, affecting manufacturing schedules and overall productivity.

Inflation

As governments print more money to stimulate economies recovering from the pandemic, inflation has inevitably impacted the cost of raw materials and labor. Companies are in a scramble to adjust their budgets and expectations.

Inflation is another enemy of stable supply chains, and it has multi-faceted impacts. It increases the cost of raw materials, affecting the bottom line of manufacturers who then pass these additional costs onto consumers, thereby affecting demand. Inflation also has a corrosive effect on purchasing power, impacting both consumers and businesses, further straining the already fragile supply chain.

As the complexities in supply chains continue to rise, the role of data becomes more crucial than ever. Understanding and harnessing data effectively can serve as a powerful tool for navigating these challenges and making informed decisions.

Section 2: The Importance of Data Collection

In today’s volatile supply chain landscape, data is not just an asset; it’s a necessity. Accurate data collection serves as the backbone of effective manufacturing procurement, empowering companies to mitigate risks and optimize operations. Here’s a breakdown of the types of data that can be particularly impactful:

Competitor Spending

Knowing where and how much your competitors are spending on materials can offer valuable insights into market trends. This information can inform your own budget allocation and identify potential areas of cost-saving.

The graph above shows the volume (in Kg) imported by a US manufacturer from overseas suppliers, with a year-on-year comparison.

Supplier Performance Metrics

Evaluating your suppliers goes beyond the dollar amount on an invoice. It’s a composite picture – price, timeliness, quality, and reliability. An insightful way to gauge reliability is by tracking whether customers of your factories are repeat buyers and the duration of their patronage. These indicators can help you score your suppliers more effectively. A comprehensive review of such performance metrics will alert you to potential bottlenecks and risks in your supply chain.

The graph above shows the detailed volume (in Kg) exported by an overseas supplier to their US customers with a year-on-year comparison.

Market Pricing

Understanding the current market pricing for raw materials and other essential components can help you anticipate future costs and better plan your budget. This is especially crucial in an inflationary environment, where costs can skyrocket with little warning.

The graph above shows the average price from the top 5 countries’ imported to the US for a specific product type (plastic building panels, plastic railings) with evolution quarter on quarter.

The data types mentioned above provide a comprehensive view of the supply chain from different angles. When combined, they offer a robust framework for making informed manufacturing procurement decisions, improving supplier performance, and ultimately ensuring a more stable and efficient supply chain.

Section 3: Data Analysis in Action

Collecting data is only the first step; the real magic happens when you dive into analysis. Understanding the nuances of your data allows you to turn raw numbers into actionable sourcing insights for manufacturing.

Identifying Trends

Trends in pricing, demand, and supplier performance are often seasonally affected or market-driven. Keeping an eye on market exports for your specific products can give you a leg up, allowing you to spot shifts to other countries before your competitors do. Understanding where others are buying can minimize your risk of getting stuck in a stagnant market. Utilizing trend analysis tools helps you anticipate these changes, enabling proactive rather than reactive strategies.

The graph above shows US import for (plastic doors, plastic window frames) by volume by quarter (in Kg) by the top 5 countries.

Are you currently tracking any specific trends that could significantly impact your sourcing decisions?

Conducting Supplier Evaluations

Going beyond just performance metrics, a deep-dive into supplier evaluations can include financial stability, historical performance, and risk assessment. This gives you a 360-degree view of your suppliers, helping you make informed decisions.

When was the last time you performed a comprehensive supplier evaluation, and what did you discover?

Assessing Risks

A thorough risk assessment can encompass various factors—geopolitical situations, material scarcity, or even labor strikes. A comprehensive risk assessment methodology can help you prepare for and mitigate these challenges in your supply chain.

What are the top three risks facing your supply chain right now, and what’s your mitigation strategy?

Market Research

Understanding your market conditions is not just crucial—it’s imperative for effective sourcing. It’s not only about comparing supply options but also staying updated on who the top factories, exporters, and emerging players are for your products. This enables you to benchmark your operations against competitors and industry standards. Being current with new developments ensures you don’t fall behind on technological advances and processes that could give your competitors an edge.

How do your sourcing strategies stack up against market benchmarks and competitors?

Image above shows top overseas suppliers exporting to the US for a specific product.

Section 4: Streamlining Supplier Evaluation with Limited Resources

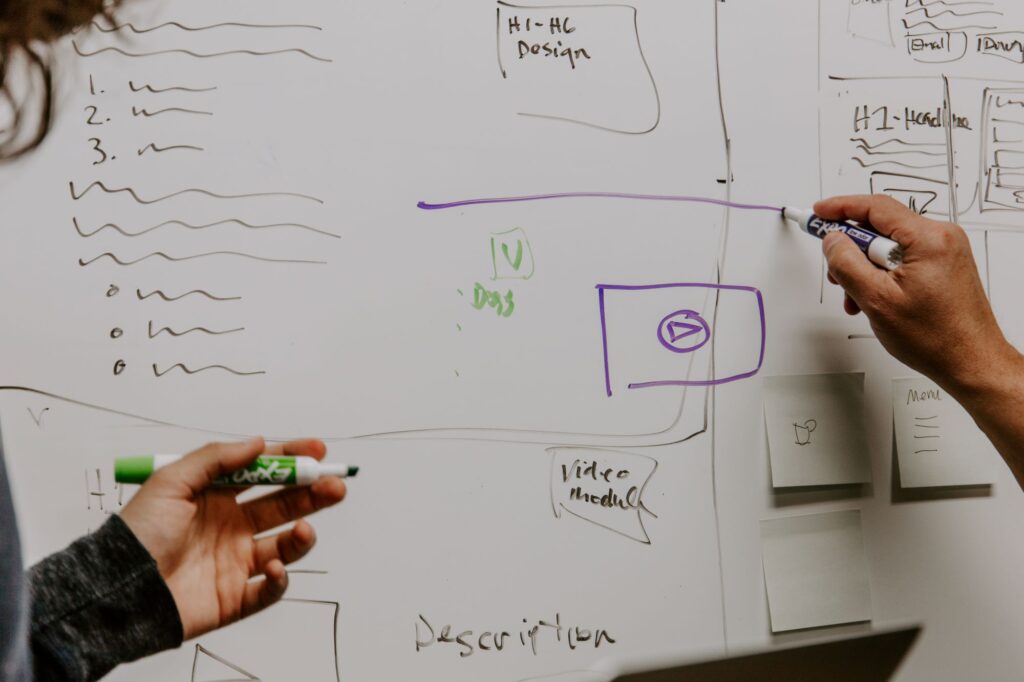

In today’s competitive landscape, effective supplier evaluation is not a luxury—it’s a necessity. However, companies operating with a lean team often face challenges in adequately vetting their suppliers. So, how do you carry out thorough evaluations without having to allocate additional human capital?

Utilize Technology for Initial Screening

Leveraging sourcing technology can cast a wider net across global factories, ensuring you don’t overlook any crucial players. Software can allow you to filter suppliers based on specific criteria such as buyers, quantities, and certifications to build a tailored shortlist. Beyond just listing potential vendors, sourcing platforms can offer preliminary reports with valuable insights into supplier performance. This includes the types of customers they serve, their customer retention rates, and the top products they specialize in. Gaining this level of understanding, even before initiating contact with the factory, saves you invaluable time—something that can typically take weeks, if not months, especially for teams with limited resources.

Focus on the Metrics that Matter

When time and resources are limited, prioritizing the right metrics is key. Look at delivery timeliness, pricing, and supply diversity when gauging a supplier’s efficacy. Be strategic and set thresholds for these indicators to quickly narrow down your options.

Automated Feedback Systems

Employ a feedback system that captures real-time data on delivery performance and product quality. This keeps your existing suppliers on their toes and informs your decisions when considering potential new partners.

Consider Certifications as a Benchmark

Certifications can serve as a quick indicator of a supplier’s compliance with industry norms and quality standards. Take these into account to further filter your options and make informed decisions. Keeping an eye on suppliers who are continuously adding certifications can also be revealing. It signals their investment in new technologies and compliance, which are good indicators that they are not a stagnant supplier. While this may not be relevant for all product lines you import, for key products, advancements in technology and materials can provide added value and unique selling points to offer your customers.

Section 5: Risk Management Strategies

Navigating the complex landscape of supply chains comes with its fair share of risks. From supplier risks to market volatility and even geopolitical tensions, there’s a lot to keep an eye on. Effective risk management is pivotal, especially when your business cannot afford disruptions or delays.

Understanding Risks at Multiple Levels

To kick off, it’s crucial to recognize the various layers of risks affecting your supply chain. We’re talking sourcing risk, geographic risk in the supply chain, and even the evolving landscape of supply chain risks in today’s world. The more you understand these risks, the better you can craft contingency plans.

The Power of Nearshoring

One trend worth noting is nearshoring, which involves sourcing from suppliers closer to your operations. This strategy not only reduces geographic risks but also enables more agile adjustments in the face of sudden market changes and customer buying habits. Nearshoring comes with the added benefit of shorter delivery lead times, allowing you to place smaller orders with your suppliers. This means you don’t have to tie up as much capital in stock (to cover the longer leadtime), making you more nimble and better able to respond to shifts in customer behaviour and market trends.”

Graph above shows quarter on quarter volume progression (in Kg) of nearshore countries (Canada and Mexico) for a product category imported to the US.

Leverage Technology for Risk Assessment

Sourcing technology is your ally in scanning and assessing risks efficiently. Automation can help you keep tabs on market fluctuations, potential supplier issues, and other variables, without the need for constant manual oversight.

Ensuring Quality Isn’t Compromised

Quality assurance is a cornerstone of manufacturing, and as you diversify your supplier base to mitigate risks, it’s crucial to ensure that quality isn’t compromised. A balanced approach that values supply diversity will not only minimize sourcing risk but also uphold your quality standards.

By having a robust understanding of these risk factors and using technologies and strategies like nearshoring and supply diversity, you can prepare and mitigate risks in an effective manner.

As you fortify your risk management strategies, the next logical step is to optimize costs. After all, effective risk management and cost optimization go hand in hand, enabling a more resilient and profitable supply chain.

Section 6: Quick Wins in Cost Optimization

In the competitive landscape of manufacturing, the pressure to reduce costs is constant. However, cost savings don’t have to come at the expense of quality or lead times. Leveraging insights from data analysis, particularly in manufacturing procurement, is crucial to finding this balance.

Firstly, strategic sourcing methods can give you an advantage in securing high-quality materials and services at competitive prices. It’s not just about scouting for the cheapest options but finding the best value tailored to your organization’s needs.

Analysing purchasing power

A critical factor that can enhance your strategic sourcing is understanding your purchasing power with suppliers. Knowing how much leverage you have is invaluable when it comes to renegotiating terms with existing or potential suppliers. Being well-informed through market intelligence and data allows you to negotiate from a position of strength.

Armed with this knowledge of your purchasing power, you’re better positioned to renegotiate contracts effectively. Market conditions are always in flux, and what was a favourable deal a year ago may no longer serve your best interests. An agile approach to contract renegotiation, backed by current data, can yield immediate cost savings without compromising on quality.

Holistic Supplier Scorecards

Moreover, don’t overlook supplier performance metrics. A high-performing supplier is not just a cost-saving asset but also a guarantee of shorter lead times and higher product quality. Keep a balanced scorecard for each supplier to quickly pinpoint the most beneficial partnerships for your business.

In summary, cost optimization is a continuous strategy, not a one-off initiative. By employing data-driven methods in manufacturing procurement and understanding your leverage over suppliers, you can achieve quick wins that have a long-term positive impact on your bottom line.

While cost optimization through strategic sourcing and understanding your purchasing power are key, these strategies become even more impactful when informed by comprehensive market intelligence. Let’s delve into how market insights can amplify your sourcing decisions.

Section 7: The Role of Market Intelligence in Manufacturing Supply and Sourcing Trends

In a world where market conditions are ever-changing, staying ahead of the curve is non-negotiable. Market intelligence plays a pivotal role in navigating the complex landscape of manufacturing procurement. By keeping an eye on market trends, industry benchmarks, and supplier dynamics, you can make informed decisions and mitigate sourcing and supply chain risks.

Actionable Steps to Leverage Market Intelligence:

Identify Reliable Sources for Supply Industry Benchmarking: Whether it’s an industry report or an analytics dashboard, make sure the source of your data is reputable and accurate.

Set up Alerts: Utilize platforms that allow you to set up notifications for key metrics like pricing changes, supply availability, or manufacturing supply and sourcing trends.

Quarterly Reviews: Make it a habit to review market conditions and supplier performance every quarter. Adjust your procurement strategy as necessary.

Questions for Reflection:

- Are you leveraging all possible sources for your market intelligence?

- How often are you reviewing and adapting your procurement strategies based on manufacturing supply and sourcing trends?

- Do you have contingency plans in place based on your supply industry benchmarking?

- By taking these steps and asking these questions, you position your organization for resilience and agility in your manufacturing procurement operations.

Section 8: Backup Supply Options to Keep Manufacturing Running

In today’s volatile supply chain landscape, having a single source for your raw materials is a risk too great to bear. That’s why a pool of pre-vetted suppliers can be a game-changer. You may think, “Pre-vetting suppliers? That sounds like a massive investment of time and resources I don’t have.” However, the reality is quite the opposite.

The Power of Pre-Vetting Through Technology

Modern sourcing intelligence platforms can simplify the vetting process, making it achievable even for manufacturers with small teams and limited resources. Through a straightforward dashboard, you can sift through various suppliers, sort by parameters that matter to you, and essentially initiate your list of ‘key vendors’ without ever having to make a phone call.

Image above shows supplier shortlist and comparison by key criteria such as volume, specialization and clients they work with.

Effort vs. Reward: Why It’s Worth It

By dedicating just a small fraction of your time to pre-vetting suppliers on such platforms, you drastically reduce future risks. Should your primary supplier fall through due to geopolitical turmoil, sudden demand surges, or any other unforeseeable events, you have a pool of vetted options to keep your manufacturing running seamlessly.

Scalability and Flexibility

Best of all, this isn’t a one-time effort. You can apply the same quick and efficient process for multiple products, focusing particularly on your key lines. This sets you up with a dynamic, flexible supply chain that can adapt as your manufacturing needs evolve.

So, the next time you find yourself hesitating over the ‘extra work’ involved in pre-vetting suppliers, remember that a little time spent today can save you a lot of trouble tomorrow. After all, in manufacturing, time is not just money—it’s also material, labor, and, most importantly, peace of mind.

Conclusion: Navigating Supply Chain Pressures in the New Normal

In today’s landscape, where the new normal is characterized by constant change and supply chain pressures, traditional methods just won’t cut it. Adopting a strategic, data-backed approach to sourcing has proven to be not just a need but a requirement for businesses aiming to navigate supply chain risks successfully.

By leveraging data analysis, market trends, and supplier evaluations, companies can fine-tune their manufacturing procurement strategies to mitigate sourcing risks and optimize costs in volatile supply chains.

Additional Resources: Enhancing Your Sourcing Technology Stack

To further support your journey towards a data-driven, risk-mitigating approach, consider adopting the following tools and technologies:

- Data Analytics Platforms: Real-time dashboards can offer actionable insights into supplier performance and market trends.

- Risk Assessment Tools: These can provide a comprehensive analysis of supply chain risks, from sourcing risks to geographic risks in your supply chain.

- Industry Reports: These are invaluable resources for keeping abreast of manufacturing supply and sourcing trends, helping you adapt your strategies in real-time.

By taking advantage of these strategies and tools, you’re not just surviving in these turbulent times—you’re paving the way for long-term success in an ever-evolving supply chain environment.

We invite you to explore sourcing data that can elevate the risk for your manufacturing business in 2024. Schedule a demo to get access to 7 days of free data.