In April 2025, a new wave of U.S. tariffs sent shockwaves through global supply chains. Fashion and apparel brands, already familiar with disruption, are once again in reaction mode, only this time, the challenge is less about a single catastrophic event and more about continuous uncertainty.

This blog explores what’s happening, how it compares to past disruptions like COVID-19, and what sourcing teams can practically do to stay ahead.

🚨 From Pandemic to Tariffs: A New Type of Disruption

For many sourcing professionals, the last time disruption felt this severe was during COVID-19. But there’s a crucial difference.

COVID-19 was a one-off global event. Supply routes shut down. Factories paused. Demand swung wildly. Teams responded, adapted, and recovered.

The 2025 tariff crisis is different: it’s unpredictable, politically driven, and changing every month. One day, a supplier in Vietnam might offer stability. The next, a sudden 46% tariff wipes out any cost advantage. Sourcing teams plan, adapt — only to have to rework everything again.

This is what’s making the current situation more stressful: not just the price increases, but the instability.

📊 What’s Changing with U.S. Tariffs in 2025?

As of April 2025, the U.S. has introduced a flat 10% universal import tariff, plus sweeping country-specific hikes affecting key sourcing regions:

- China: Up to 145% on apparel and accessories

- India: 27%

- Vietnam: 46%

- Cambodia: 49%

- Indonesia: 32%

- Turkey: 10%

- EU (EU): 20%

Retail sourcing categories hardest hit include t-shirts, denim, footwear, and accessories, some of the core product lines for fashion brands.

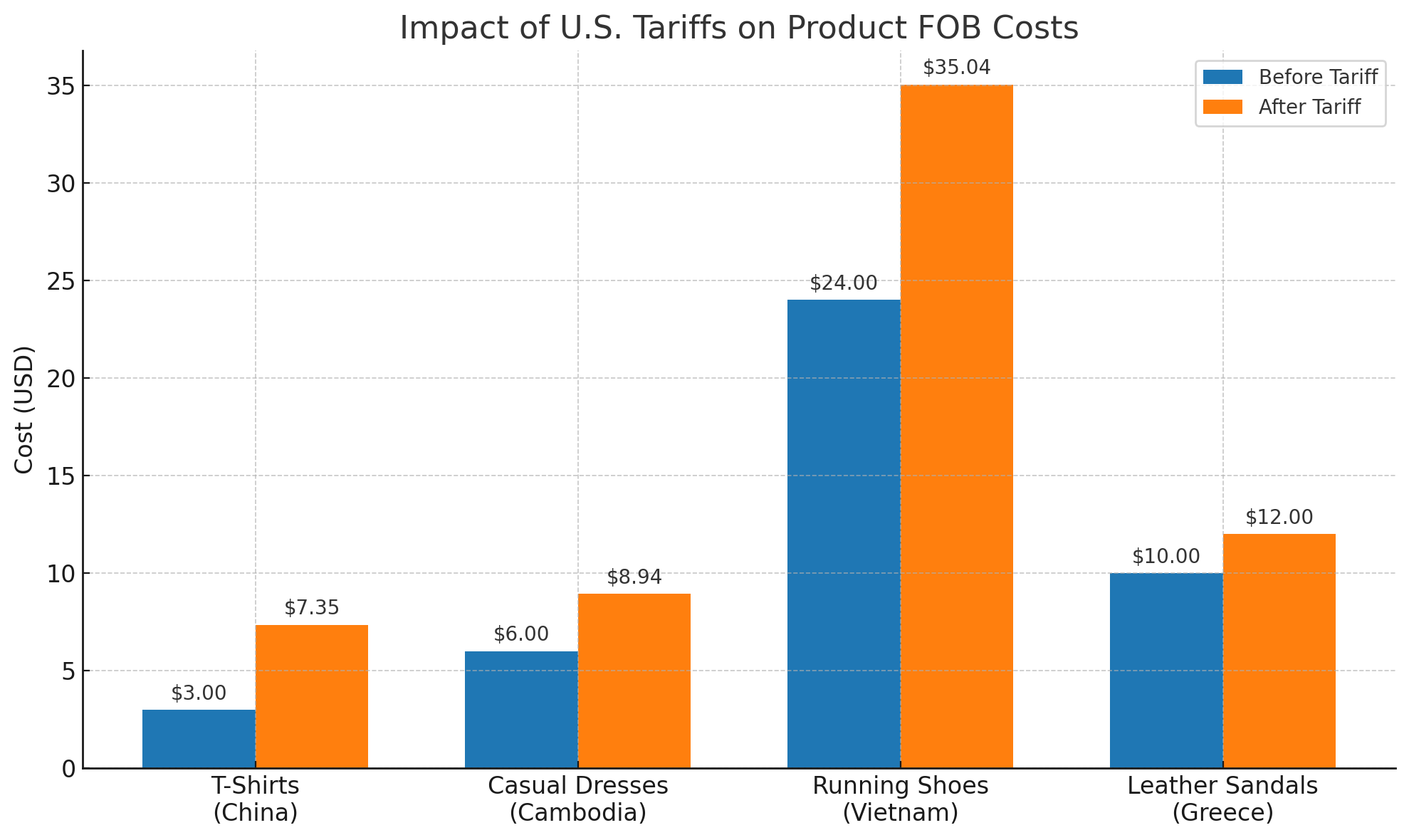

🧵 Real-World Cost Impact: A Few Examples

While this blog avoids extensive pricing tables (since numbers shift quickly), here are a few indicative examples of how tariffs are affecting day-to-day costs:

- T-Shirts from China:

Before tariffs: ~$3.00 FOB

After 145% tariffs: ~$7.35 - Casual Dresses from Cambodia:

Before tariffs: ~$6.00 FOB

After 49% tariffs: ~$8.94 - Running Shoes from Vietnam:

Before tariffs: ~$24.00 FOB

After 46% tariffs: ~$35.04 - Leather Sandals from Greece:

Before tariffs: ~$10.00 FOB

After 20% tariffs: ~$12.00

These examples demonstrate the margin pressure companies now face — and explain the urgency behind sourcing strategy shifts.

🧠 The Real Issue: Volatility, Not Just Cost

Our customers tell us: “It’s not just that costs are going up. It’s that we don’t know what’s going to happen next.”

That’s the heart of the issue. In the current climate, you don’t just update your sourcing strategy — you stay in a constant loop of reviewing and reacting. You shift from China to India, only for India to get hit with new tariffs. You explore nearshoring, but costs outweigh short-term gains.

⚡️ Common Day-to-Day Struggles for Sourcing Teams:

- Pressure to hold margins while maintaining quality and speed

- Constant internal debates: “Should we leave China?” “Where is our safest Plan B?”

- Limited competitive intelligence — what are other brands doing?

- Supplier renegotiations under new pricing pressure

- Internal stakeholders from finance, merchandising, logistics all needing answers now

🛠️ What Can You Actually Do About It?

Here’s some practical, daily-level advice sourcing teams can implement to manage the volatility:

✅ 1. Build a Multi-Region Supplier Pool

Don’t just swap one country for another. Build relationships across three or more regions (e.g., India, Turkey, Mexico) to ensure agility.

- Develop a shortlist of 2–4 backup suppliers in different countries.

- Ensure you have at least one supplier in a low-tariff or FTA-aligned country.

- Test small sample orders from alternative regions to de-risk future pivots.

✅ 2. Track Competitor Movements

Monitor where others are shifting their sourcing — if everyone’s flooding Vietnam, capacity constraints and cost rises might follow.

- Use trade data or tools like Sourcing Playground to monitor where others are sourcing.

- Watch for capacity crunches — if your competitors all shift to Turkey, lead times may suffer.

✅ 3. Create a “Tariff Trigger” Playbook

Write internal scenarios: “If X tariff is announced, we activate Plan Y supplier list.” Pre-load quotes, samples, and onboarding steps so you’re not starting from scratch.

- Write internal SOPs for tariff-related shifts.

- Keep a living document: “If tariffs on Country X hit Y%, activate Plan Z.”

- Include pre-approved alternative supplier quotes, terms, and logistics plans.

✅ 4. Use Tech to Watch Simulate Costs & Scenarios

Platforms like Sourcing Playground can help you watch competitors and trade flows.

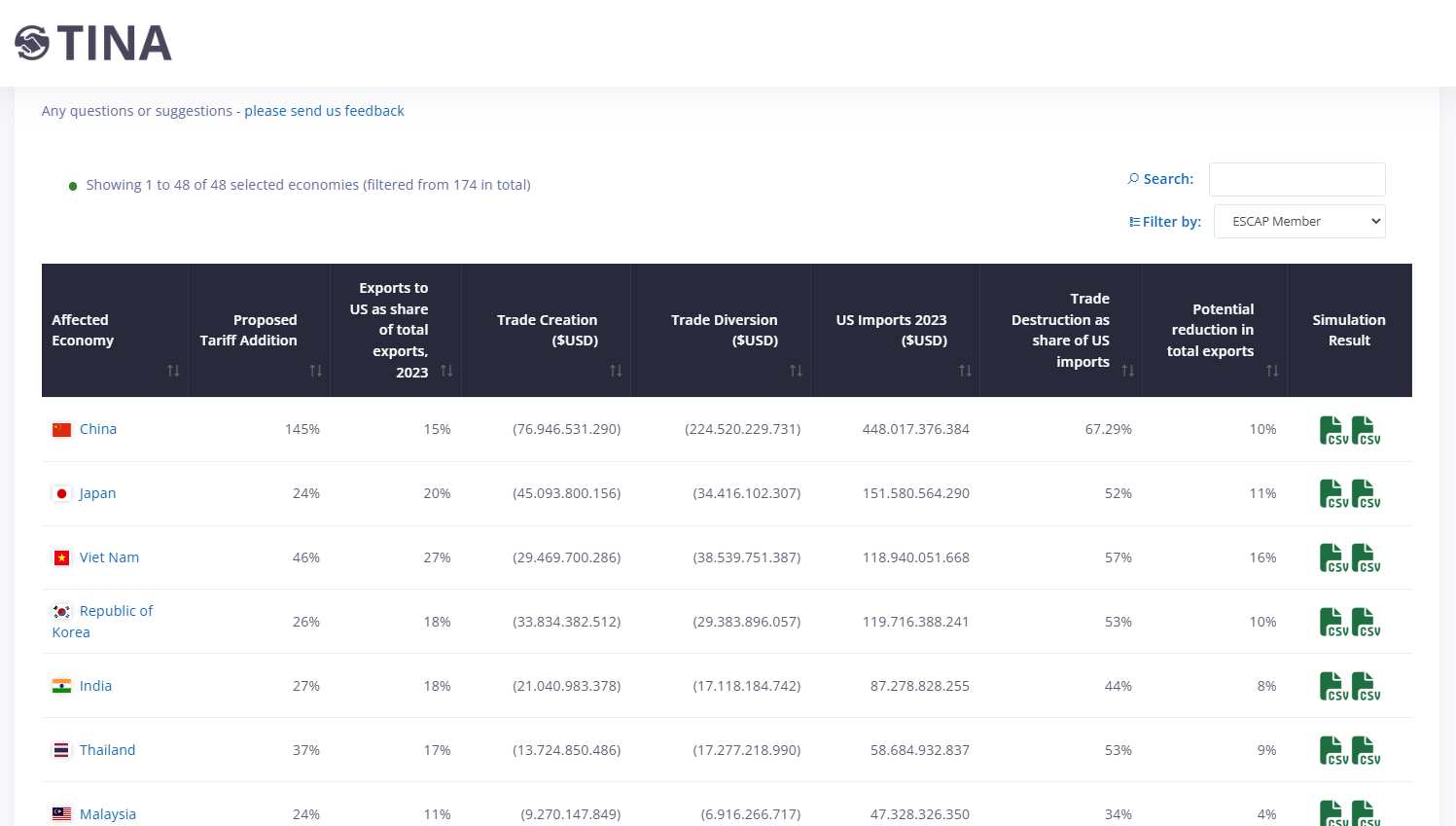

Tina – allows you to keep an eye on current tariffs by country and also simulate by HS codes.

![]()

✅ 5. Tighten Internal Alignment

Host weekly 15-minute huddles with finance, logistics, and product teams. Share intel, flag risks, and align on trade-offs before they become problems.

👀 Top Countries to Watch in 2025 for Apparel Sourcing

As of April 2025 here are a few countries that are emerging as lower-tariff alternatives to traditional sourcing hubs:

- Turkey: Low tariffs, strong textile infrastructure

- Mexico: Nearshoring advantage for U.S. importers

- Bangladesh: Competitive pricing, especially in basics

- Jordan: Favourable trade agreements with the U.S.

- Egypt: Duty-free access under QIZ agreements

For more details use the tariff tracker Tina here

🧰 Top Questions Sourcing Teams Are Asking (and Answering)

Q: Should we stop sourcing from China completely?

A: Not necessarily. Many teams are reducing exposure, but keeping strategic capacity in place.

Q: Which countries are best for low-tariff apparel sourcing in April 2025?

A: See above — Turkey, Mexico, Bangladesh, Jordan, and Egypt are top options. Keep an eye out for changes here.

Q: How can we plan when tariffs keep changing?

A: Build agility into your sourcing strategy with multi-region sourcing and tariff triggers.

📧 Template: Supplier Outreach Email (for Switching Due to Tariffs)

Subject: Exploring New Opportunities Due to Market Changes

Hi [Supplier Name],

Due to recent changes in U.S. import tariffs, we are reviewing our sourcing strategy across multiple categories. We value our relationship with you and would like to understand:

• Your production capacity in other regions (if applicable)

• Any flexibility you may have in cost structure or lead time

• Existing compliance documentation (e.g. GSP, QIZ, FTAs)

Our goal is to find a sustainable way forward for both sides. Let us know a good time to connect.

Best regards,

[Your Name]

[Your Company]

🚀 How Sourcing Playground Helps Teams Navigate Trade Chaos

Our platform is built to make life easier for sourcing professionals dealing with the current volatility. Here’s how:

- Monitor competitors: See where other brands are sourcing

- Find new partners: Discover compliant, reliable factories in lower-tariff markets, with contacts

At Sourcing Playground, we also create custom sourcing reports to help companies navigate the impact of US trade tariffs and shifting global supply chains. Each report is tailored to your specific product categories and competitors, providing insights into country-of-origin trends, supplier profiles, and sourcing opportunities. Whether you need one-off support or deeper market intelligence, our reports are designed to inform strategic decisions with real, actionable data.

Send us an email or book a meeting to discuss a custom report for your sourcing teams.

📆 Glossary: Common Tariff & Trade Terms

- FOB (Free On Board): The price of goods including loading onto the shipping vessel

- Landed Cost: Total cost of goods including tariffs, shipping, insurance, and duties

- MFN Tariff (Most Favored Nation): Standard WTO-agreed tariff rate for most trading partners

- FTA (Free Trade Agreement): Bilateral or multilateral agreement that reduces or eliminates tariffs

- QIZ (Qualified Industrial Zone): Designated zones (e.g. in Jordan or Egypt) with duty-free access to the U.S.

- Section 301 Tariff: A U.S. trade remedy allowing tariffs for unfair trade practices

📅 Conclusion: Agility Is Your Advantage

Sourcing professionals aren’t just managing suppliers, they’re navigating a global maze of cost volatility, political shifts, and internal pressure.

The good news? You’re not alone. And you’re not without tools.

Whether it’s building flexibility into your sourcing strategy, staying ahead of the curve with cost simulations, or being the voice of clarity when your stakeholders need answers your impact is bigger than ever.

Platforms like Sourcing Playground are here to support you. But so are your instincts, your network, and your strategic mindset.

The best sourcing teams aren’t just reacting to disruption — they’re redefining what smart, agile supply chains look like.

Now’s the time to lead.

Get in Touch With Us

📞Book a meeting to discuss a custom report for your sourcing teams: here

📧Send us an email: heather@sourcingplayground.com